The Prime Minister’s Youth Loan Scheme 2023 Online Application Last Date check on this page. If you’re interested in applying for this Prime Minister Youth Loan Scheme it is recommended that you submit an online form to apply. On the official website that is operated by the Ministry of Youth Affairs and Sports, You can find an application form that you can complete online.

If you’re looking for a quick and simple method of applying for a loan through the government, there’s no need to search any further. you can access the Prime Minister Youth Loan Application Online Form in order to receive the cash you require in the shortest time and with the most ease possible. Application forms for the Prime Minister Youth Loan are accessible on the internet. The loan is available to students who have completed their training or have completed their final year at college. You can get up to the amount of Rs100,000.

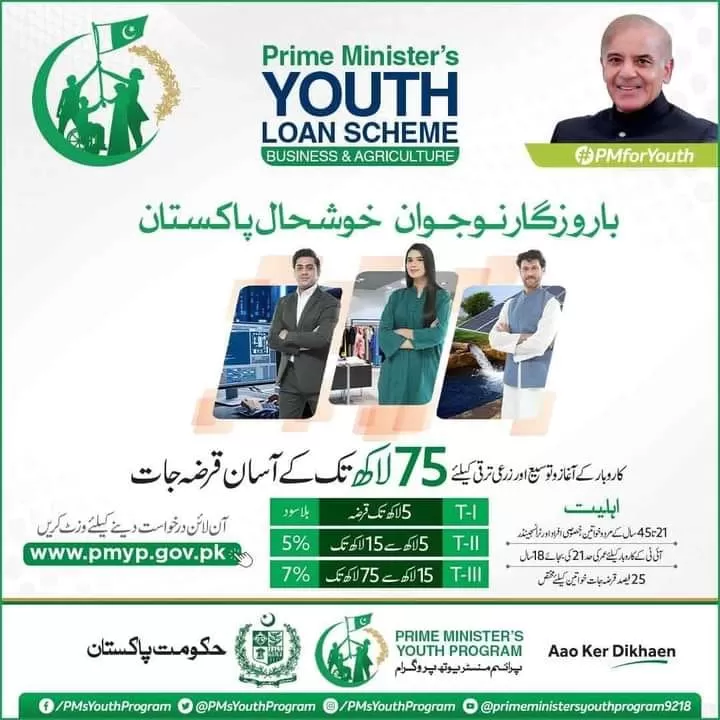

Youth Loan Scheme 2023 Check Details

Youth Loan Scheme 2023 Online Application Form

In the “Primary Ministers Successful Young SME Landing Program,” the State Bank gave out a loan to help young entrepreneurs create small-scale companies. The loans were at no cost and offered simple conditions. State Bank says that the loan application forms can be obtained from the nearest National Bank, Bank of Punjab as well as the Bank of Khyber branch or on their websites. PM Kamyab Jawan Loan Program 2023 Eligibility Criteria Online Application Deadline. Banks are being instructed to include their toll-free number on the application forms so that young people can assist in running their businesses.

PM Business Loan Scheme 2023 Eligibility Criteria

- All the information available on Kamyab Jawan Program is almost the same as this loan scheme

- All men/women holding CNIC, aged between 21 and 45 years with entrepreneurial potential are eligible. For IT/ E-Commerce related businesses, the lower age limit will be 18 years.

- Small and medium enterprises (startups and existing businesses) as per the definition of SBP and owned by youth as per above mentioned age brackets are also eligible.

- For IT/E-Commerce-related businesses, at least matriculation or equivalent education will be required.

- This scheme is for both startups as well as existing micro and small business enterprises.

- You can always re-apply if you want to avail the increase in maximum loan size announced recently.

- No physical application is not allowed. All applications have to be submitted online

- The minimum age for the applicant under this scheme is 21 years at the time of application submission. However, it is relaxable to 18 years in case of applicants applying for IT or Computer related businesses. The maximum age limit is 45 years at the time of application submission.

- At least one business partner’s/director’s age should comply with the age limit defined under this scheme (21-45 years).

- There is no general requirement for minimum educational qualification, though it will be a favorable

consideration for decision-making by banks. However, in the case of businesses that compulsorily require certain qualifications, certifications, diplomas, authorizations, or licenses, the same must be held by the applicant. - There is no gender discrimination in this scheme and applicants of all genders are offered equal opportunities. However, considering the ground realities and to protect the fair gender, a minimum of 25% share on the aggregate basis of all loans is kept for women.

- Persons employed in private jobs can also apply

- Existing micro and small enterprises can also benefit from this scheme.

- One family member cannot apply in another’s name.

- This scheme is only for resident Pakistanis

- A person cannot avail of more than one loan

- Blood relatives of employees of participating banks cannot apply for loans under this scheme from the banks where their blood relatives are employed

- Government employees are strictly barred from applying under this scheme.

- All businesses which are ethical and permitted under the law are eligible for this scheme.

- Applicants are advised to select businesses that are ethical, legal, commercially viable, and suitable for applicants’ respective areas and for which applicants possess the required minimum knowledge, experience, training, and support

PM Kamyab Jawan Loan Program 2023

Fill in the application online and provide all the details required, such as your personal details, business plan, and financial details. Complete the application form with all required documents like identification proof and proof of residency, along with financial records. When your application is sent to the appropriate people, they’ll look through it and inform you of what they think in several weeks. If your application is approved then you’ll receive the loan in accordance with the terms and conditions of the program.

Kamyab Jawan Loan Program 2023 Apply Online

When the Prime Minister launches the program, application forms will be made available as soon as possible. In the program, young entrepreneurs can receive loans ranging from one million up to fifty lacks in order to begin their own businesses. The government will cover the interest on these loans and will be responsible for repairing any losses.

Click Here to Apply For the PM Youth Loan Scheme

How to Get a PM Youth Business Loan 2023?

The Youth of the Prime Minister Business Loan Scheme is a program that offers money to business owners who are just starting out in Pakistan and wish to establish their own business or grow the size of an already existing business. To be qualified for this loan, you must satisfy the following requirements:

- You must be between 21 to age 45.

- It is necessary to be a resident of Pakistan.

- You need to have a National Identity Card that is still valid.

- It is essential to come up with an idea for an organization that could generate jobs and boosts to boost the economic growth of your nation.

- If you satisfy these criteria If you meet these requirements, take these steps in order to be eligible for a loan

- Visit the official website for information on Youth Business Loan Scheme from the Prime Minister.

- On the homepage, click”Apply Now” on your home page “Apply Now” button.

Documents Required for PM Loan Scheme 2023 for Youth

- A passport-sized CNIC photo (front as well as back)

- Educational credential or diploma (if relevant)

- Experience evidence (if appropriate)

- Registration/licensing with a business chamber (if applicable)

- An endorsement letter issued by the appropriate chamber or trade union or labor association (mandatory in the case of a current business).